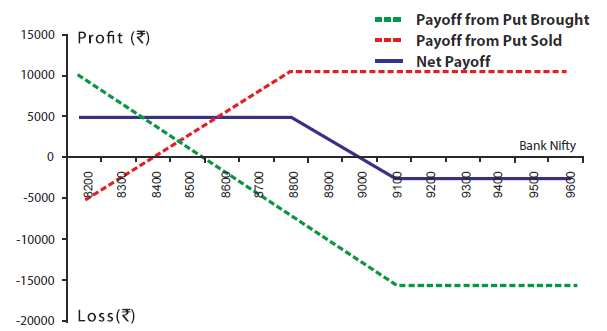

Bear Put Spread Payoff

The stock market crash of 1929 put an end to the Roaring 20s and started the Great Depression. Vega is slightly higher and theta is slightly lower on the diagonal spread vs the calendar.

Bear Put Spread Option Strategy Explained

Bien que ce ne soit pas une obligation les straddle sont dans limmense.

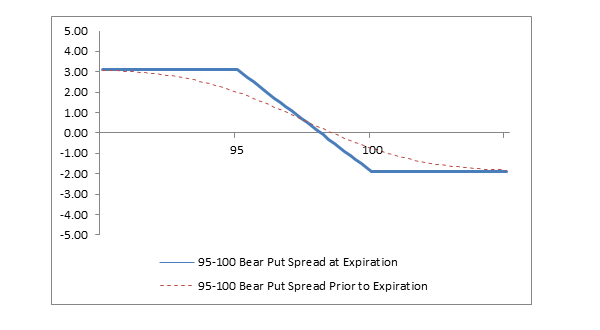

. Consider hypothetical stock Skyhigh Inc. The Bear Call Spread is similar to the Bear Put Spread in terms of the payoff. Bear put spread is best invoked when you are moderately bearish on the markets.

Calendar Spread vs Iron Butterfly. Calendar spreads and butterfly spreads have quite similar payoff diagrams in that they have the tent shape but there are slight. Like the case of a single option the instance methods are vectorized so we can compute payoff and profit across a vector or grid.

When you buy and own a put option you have a long put position. Which claims to have invented a revolutionary additive for jet fuel and has recently reached a record high of 200 in volatile. In options trading a box spread is a combination of positions that has a certain ie riskless payoff considered to be simply delta neutral interest rate position.

There are just a few differences which we will point out. If you have seen the page explaining call option payoff you will find the overall logic is very similar with puts. Here we are short a put at 1950 and long a put at 2050.

In equilibrium a protective put will have the same net payoff as merely buying a call option and a protective call will have the same net payoff as merely buying a put option. This investment strategy provides for minimal risk. They are long the put option.

Here is an example of constructing a bear spread which is a combination of 2 puts or 2 calls put is the default. Additionally it can lead to an arbitrage. To roll the position purchase the existing bull put credit spread and sell a new spread with a later expiration date.

When comparing the credit put spread vs other risky trades such as day trading penny stocks you can easily see the big difference. Bull Call Debit Spread payoff diagram. A dual option position involving a bull and bear spread with identical expiry dates.

With no relief in sight as local officials have showed no empathy there is talk of alleged payoff to host the Manila Water Cardona plant. For example a bull spread constructed from calls eg long a 50 call short a 60 call combined with a bear spread constructed from puts eg long a 60 put short a 50 put has a constant payoff of the. Definition of bear with us in the Idioms Dictionary.

Please do bear in mind the payoff is upon expiry which means to say that the trader is expected to hold these positions till expiry. A protective option could be used instead of a stop-loss order to limit losses on a stock position especially in a fast-moving market. See also short put payoff inverse position.

The stock market contracted so much that it would take until 1954 to fully regain its pre-crash value. Whereas the stock price for this credit put spread doesnt even have to move. Lacheteur dun straddle bénéficie donc des mouvements du sous-jacent quelle quen soit la direction.

But in fact the security they really own is the put option. From pyfinance import options as op. Looking at the diagonal spread below there is delta of 27 and delta dollars of 7654.

This page explains put option profitloss at expiration payoff diagram and break-even calculation. Put up with make allowance for. If the stock price has moved down a bear put debit spread could be added at the same strike price and expiration as the bull call spread.

For example if the original bull put spread has a June expiration date and received 100 of premium an investor could buy-to-close BTC the entire spread and sell-to-open STO a new position with the same strikes in July. The bull call spread payoff diagram clearly outlines the defined risk and reward of debit spreads. Bear Call Spread Example.

Le straddle ou stellage est une stratégie optionnelle consistant à acheter ou à vendre le même nombre de puts ou de calls sur la même valeur sous-jacente avec les mêmes dates déchéance et prix dexercice. Trying to execute a swing trade on penny stocks would require an explosive move to realize the same gain 471 in this example. 81 Choosing Calls over Puts Similar to the Bear Put Spread the Bear Call Spread is a two leg option strategy invoked when the view on the market is moderately bearish.

Scenario 1 Market expires at 7800 above long put option ie 7600. For them to make a profit the put option must increase in price so they can sell it for a higher price than for which they have bought it. Bear with us phrase.

Bear Put Debit Spread Guide Setup Entry Adjustment Exit

Bear Put Spread Explained Online Option Trading Guide

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-04-d02438bef9d24de79e98dd8d29b157f8.png)

0 Response to "Bear Put Spread Payoff"

Post a Comment